Daily Report: Investors' focus on Australian CPI and others

Dollar Broadly Higher as Geopolitical Risks Subdue.

FXPrimus has summarized the important market indicators of the day.

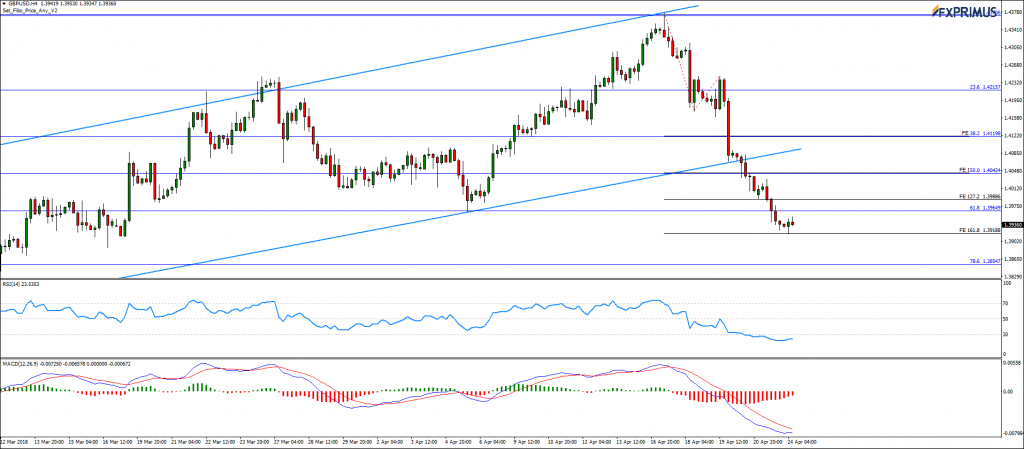

Today’s Important Indicators

Economic slowdown in Europe and China may support the Dollar’s initial attempt to break to fresh 9-week highs further while US Yields are indeed in an upside movement.

With the trade war rhetoric becoming less and less intense the Dollar dominated Monday’s session against all pairs, extending the currency’s gains as US Yields bumped into 3%. Oil was the only survivor.

Markets will focus on the CB Consumer Confidence report at 2PM GMT today.

Today’s Forecast for Important Trading Indicators

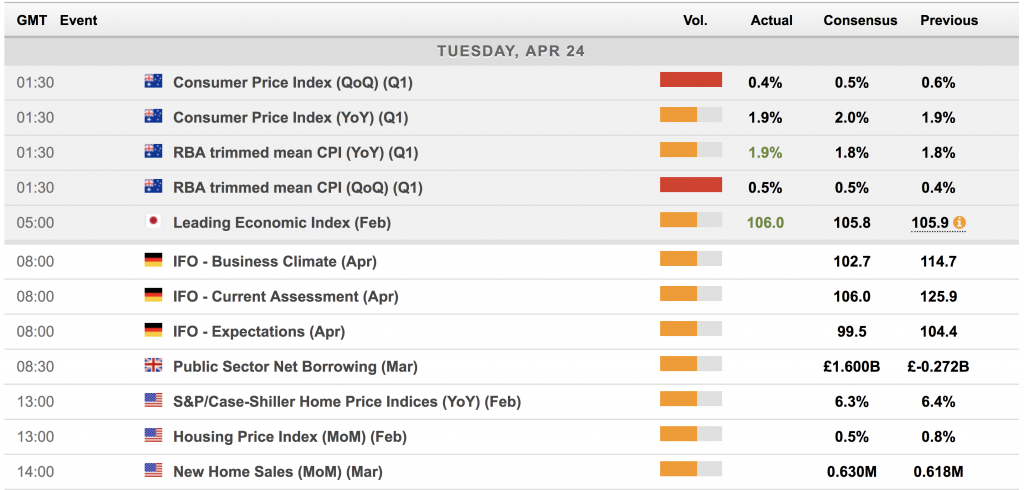

- BTC/USD – Bitcoin continues with bullish rally as long investors break $9K struggle, 7-day high hit. Bitcoin moved higher for another session, moving away from recent broken triangle pattern and most recent support at $7.9K. With a 27% surge since April it is likely that the price will continue higher, but investors will look at taking profits at critical psychological or technical levels; $9.55K is one.

MARKET MOVERS

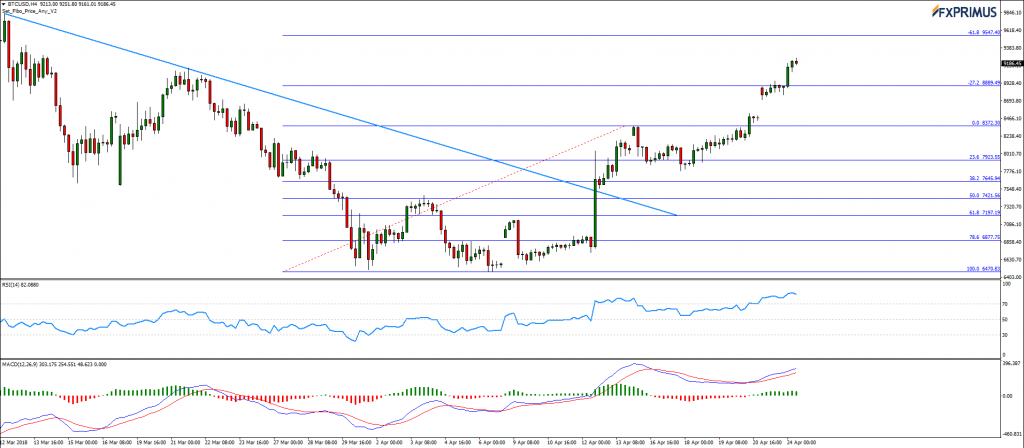

- EUR/USD – Euro declines for third consecutive session as risk positioning shifts market sentiment. Euro fell to the bottom of its range at $1.22 yesterday as Dollar posted substantial gains while US Yields rallied to 3%. With ECB being the highlight of the week and price threatening the bottom side of the range, Draghi’s Conference is likely to be the catalyst for directional activity. German Ifo may create some opportunities today.

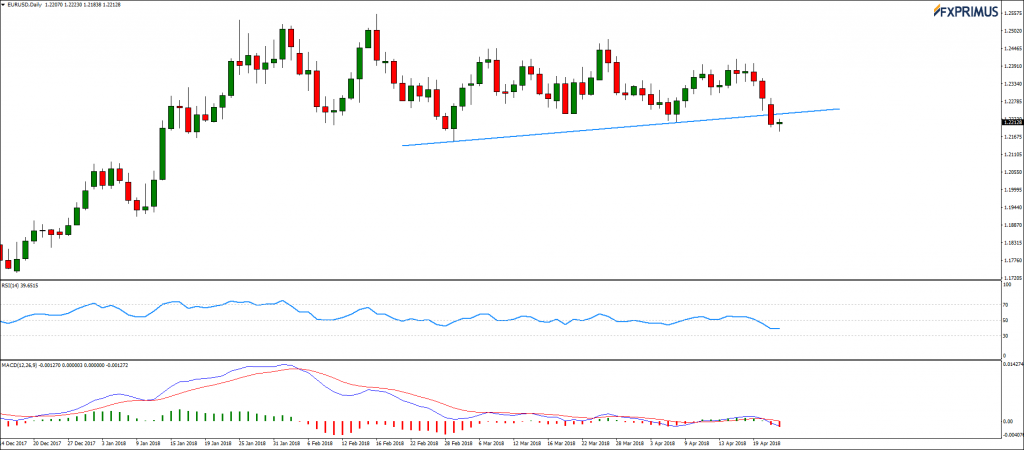

- GBP/USD – Pound suffers for the fifth straight trading day, breaks below symbolic $1.40. Cable slipped nearly 60 pips in the Monday session, posting further losses away from the ascending channel started on March 1. No indicators were due, hence, Dollar’s strength and the widening spread of Yields took the pair below the symbolic $1.40 level. A breather at the 161.8% FE is seen.

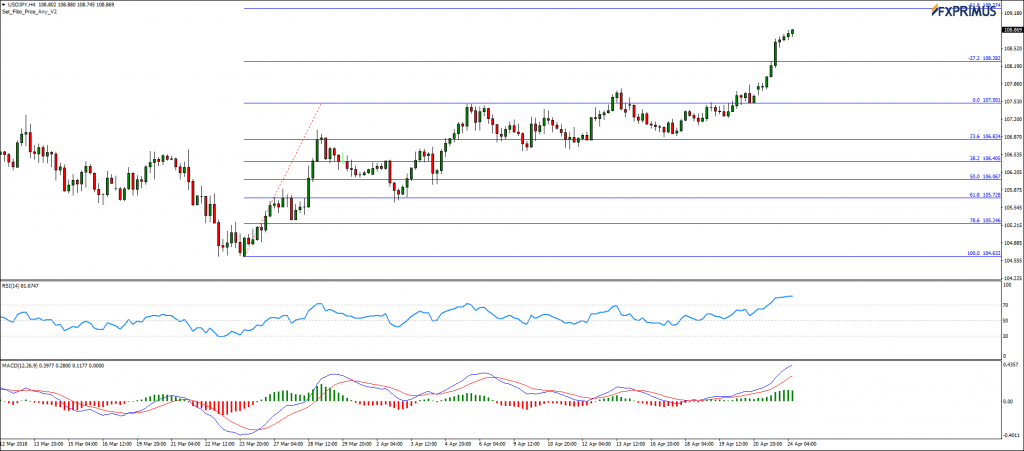

- USD/JPY – Japanese Yen slips lower as trade war fears subdue, yield spread widens. Dollar-Yen reached a 9-week high on Monday following a shift in risk appetite while fears surrounding the escalation of the US-China trade war eased. The pair traded beyond 108 and is heading toward 109 while risk sentiment swells. CB Consumer could add more risk in the markets, 2PM GMT today.

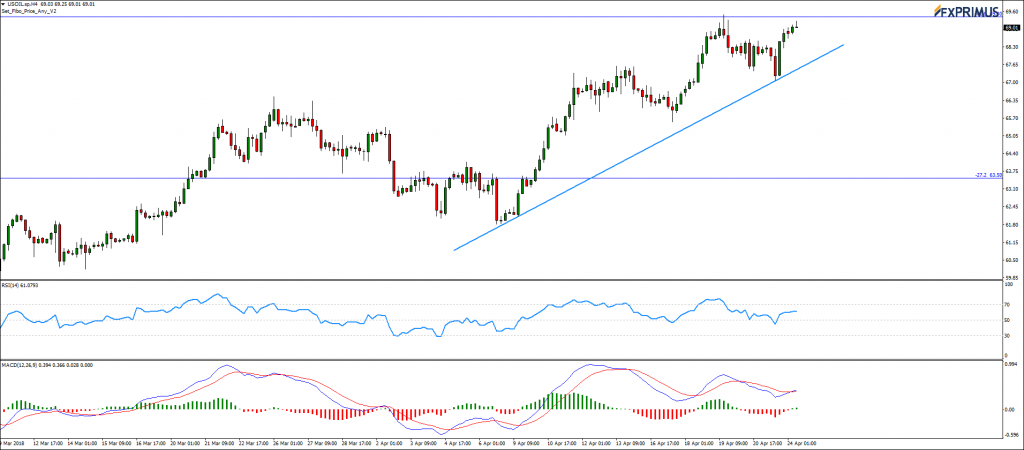

- USOIL – Oil long narrative maintained as Oil sanctions against Iran may kick-in, inventories declining. WTI rebounded from a daily low of $67/b as deliberate fire attack on Libya’s Es Sider export terminal caused disruptions. With repairs lasting a few days and a loss of 80,000 bpd per day Oil price is likely to be influenced at least until EIA’ report tomorrow at 2.30 PM GMT. Oil remains bullish.

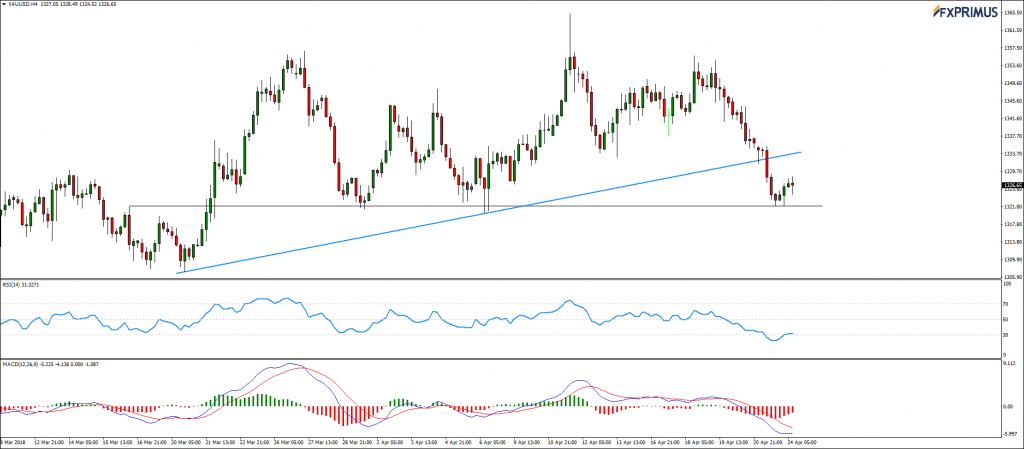

- XAU/USD – Gold slips $10/oz lower as investors go long on risk, US Yields hit 3%. Gold posted sharp losses on Monday breaking the ascending trendline while rising Yields took Dollar higher. Gold investors remain alert as inflationary pressures weigh in. Price is trading below 1330 and the trendline, yet, halted at the 1320 support. CB Consumer to provide somewhat clearer signals.

- US Indexes – DJ closed 0.06 % lower, S&P 500 remained at same trading levels.

- European Indexes – UK 100 rose 0.35%, DE 30 0.16% higher.

- Asian Indexes – ASX 200 soared by 0.56%, Nikkei 225 gained 0.86%, Hang Seng trades 1.17% higher.

- US Equities – Tesla declined by 2.37%, Exxon Mobil appreciated by 0.72%