ECB and BoE leaves interest rates unchanged and EUR & GBP falls. What to expect from the market today?

ECB & BoE Rates Steady, Markets Likely to Remain Quiet.

FXPrimus has summarized the important market indicators of the day.

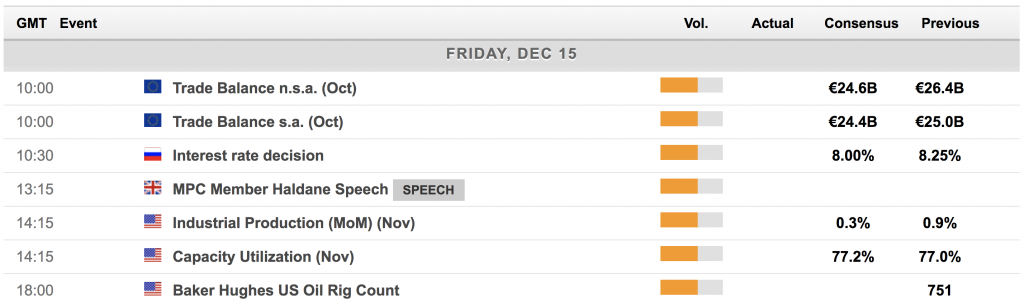

Today’s Important Indicators

With ECB and BoE leaving rates unchanged investors had no option but to sell EURO and POUND.

Despite both decisions being bearish, STERLING managed to stay on the side-lines amid earlier data on Retails Sales.

Today no major economic events are due, hence, markets are likely to be quiet.

Today’s Forecast for Important Trading Indicators

Market Movers

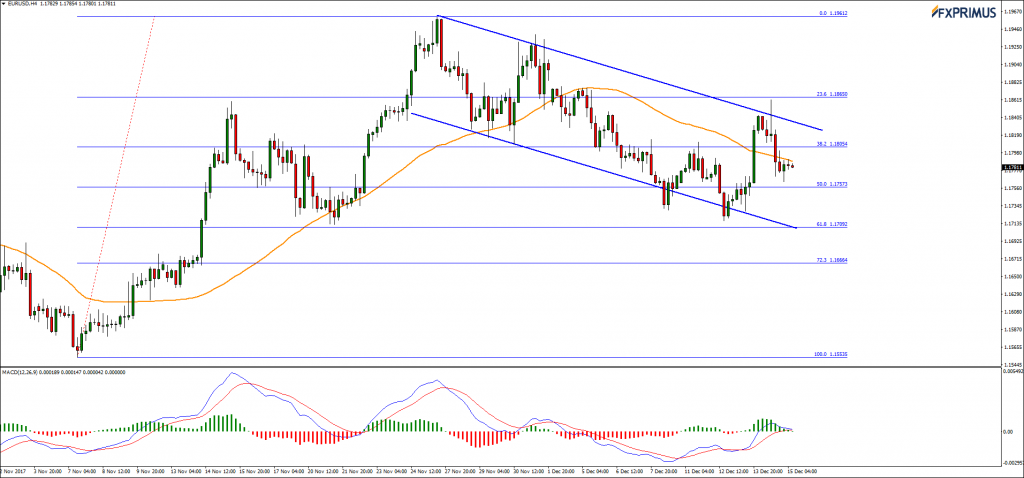

- EURUSD – EURO slips on steady rates, tapering of Quantitative Easing (QE) still open-ended. EURO lost nearly 100 pips from the daily high of 1.1865 closing below $1.18 following ECB’s decision to leave rates unchanged near 0.00%. Bulls remain in power as long as the 61.80% FR at 1.1757 reject downward pressure despite the price subdued below the 50 4MA.

- GBPUSD – POUND falls on BoE hold, recovers as consumer confidence increases. Cable saw temporary losses following BoE’s decision to keep rates steady, falling some 30 pips. On the economic indicators front, Retail Sales raised to 1.10%, nearly three times higher than what anticipated, supporting bullish sentiment. Price swing led the pair to closing the day unaltered.

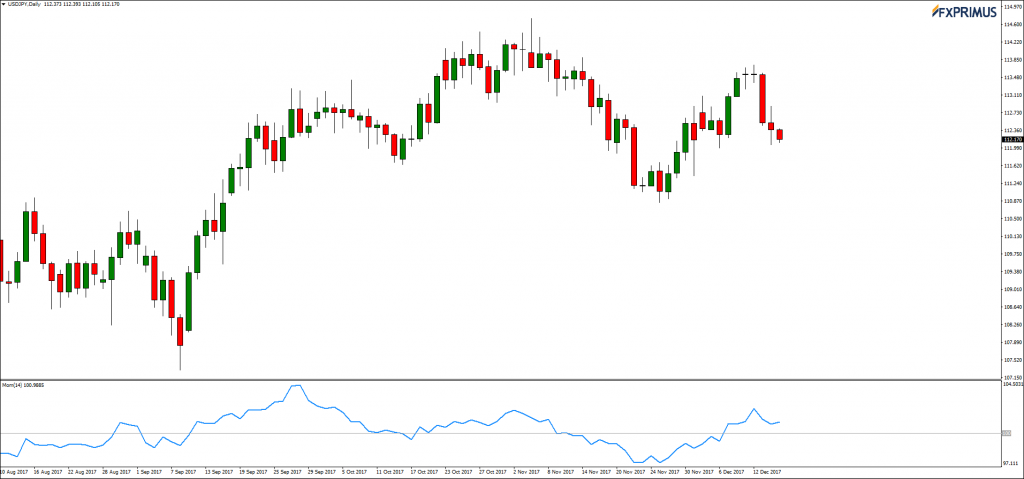

- USDJPY – DOLLAR remains steady as emphasis shifted to European rates decisions. Dollar experienced a rather illiquid session as attention turned to ECB, BoE and SNB. Despite good data were released on the consumer confidence front and an extraordinary Jobless Claims report was delivered, DOLLAR remained under pressure. Although the session ended with an indecision candle, bears won the daily battle, but not momentum.

- USOIL – OIL raises on increased confidence around curbing global oversupply of Crude. OIL surged back above the $57 per barrel mark as IEA provided to investors a positive supply/demand outlook. After a rejection at the $56, price rose over $1 per barrel despite worrisome Gasoline stockpiles. OIL is likely to close the week unchanged.

- XAUUSD – GOLD follows steady DOLLAR, weekly gain assured $20/oz away from weekly low. Spot GOLD closed near $1252/oz yesterday, a tad lower than the day before yet still unchanged, owed to a subdued DOLLAR. Investors seem willing to take price higher today as GOLD is trading $4/oz higher already.

- US Indexes – DJ fell 0.31%, S&P 500 slipped by 0.41%

- European Indexes – UK 100 declined 0.65%, DE 30 depreciated by 0.44%

- Asian Indexes – ASX 200 weakened by 0.15%, Nikkei plummeted 0.62%, Hang Seng trades -1.03%.

- US Equities – Twitter climbed 4.25% higher, Amazon followed with a 0.87% gain.